Vanadium Miners News For The Month Of June 2022

[ad_1]

Evgeny Gromov/iStock via Getty Images

Welcome to the Vanadium miners news. June saw generally flat vanadium prices and a slower month of vanadium news.

Vanadium uses

Vanadium is traditionally used to harden steel. New Chinese rebar standards are requiring more vanadium. Also Vanadium Flow Batteries [VRFBs] are becoming increasingly popular especially for commercial energy storage, most notably in China. Vanadium Pentoxide [V2O5] is used in VRFBs and Ferrovanadium [FeV] is used in the steel industry.

Vanadium spot price history

Europe Vanadium Pentoxide [V2O5] Flake 98% 1 year chart – Price = USD 9.50/lb (China price not given)

Vanadiumprice.com![Europe Vanadium Pentoxide [V2O5] Flake 98% 1 year chart](https://static.seekingalpha.com/uploads/2022/6/28/37628986-16564715721308131.png)

China and Europe Ferrovanadium [FeV] 80% prices – China = USD 39.00/kg, Europe = USD 36.25/kg

Vanadiumprice.com![China and Europe Ferrovanadium [FeV] 80% prices](https://static.seekingalpha.com/uploads/2022/6/28/37628986-16564716476084487.png)

Vanadium demand versus supply

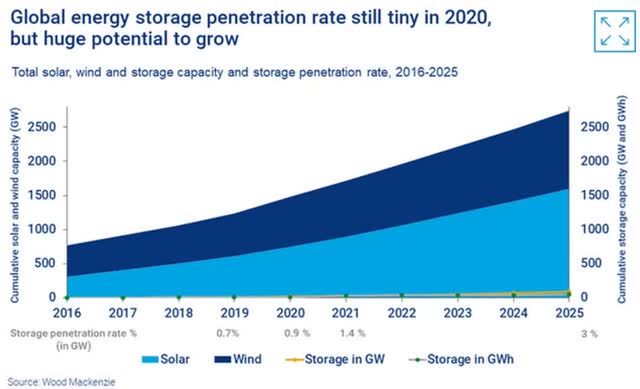

An April 2021 Wood Mackenzie report stated:

Global energy storage deployment surged a remarkable 62% in 2020, with 5 GW/9 GWh of new capacity added. This brought the total energy storage market to more than 27 GWh. Furthermore, we expect the global (energy storage) market to grow 27-fold by 2030.

Woodmac forecasts high growth ahead for solar, wind and energy storage

Woodmac

An early 2021 Roskill post stated:

The vanadium market is set to tighten over the year and more so in 2022, driven by higher demand but also by tighter supply, as Chinese steel slag producers are running close to capacity. Outside of China, incremental supply will also be limited and come mainly from AMG’s new facility in Ohio, USA, and Bushveld’s Vametco gradually increasing its production in South Africa… Vanadium redox batteries (VRBs) could become a major market for vanadium amid growing demand for energy storage, should the technology develop… On the supply side, Roskill does not expect significant tonnages from new projects to enter the market before 2024.

In 2017 Robert Friedland stated:

We think there’s a revolution coming in vanadium redox flow batteries…

Vanadium market news

On June 6, 2022, Stockhead reported:

Vanadium stocks guide: Here’s everything you need to know… It’s taken a while for investors to realise the potential of vanadium in the battery metals race, but interest is starting to pick up. While EV production is a hot topic, stationary energy storage applications – where vanadium is needed, has industry experts particularly excited… BloombergNEF says energy storage applications around the world will multiply exponentially from a modest 9GW/17GWh in 2018 to 1,095Gw/2,850GWh by 2040, marking a 122-fold boom over the next two decades. Vanadium producer CEO Fortune Mojapelo says if vanadium redox flow batteries capture just 10pc of the stationary battery market, by 2030 global production of vanadium will need to increase by as much as 50pc. The outlook is big but while vanadium is set to become a key resource in the fast-growing battery sector as part of the renewable energy mix, most of its consumption (around 90pc) is used to strengthen steel. Of the remainder, vanadium is used in aerospace alloys and chemical catalysts, and 1pc goes into vanadium redox flow batteries (VRFBs), which are regarded as a safer alternative to lithium-ion and better suited to large-scale applications. They come at a higher upfront cost but have a far longer life compared to lithium-ion batteries.

Note: Bold emphasis added by the author.

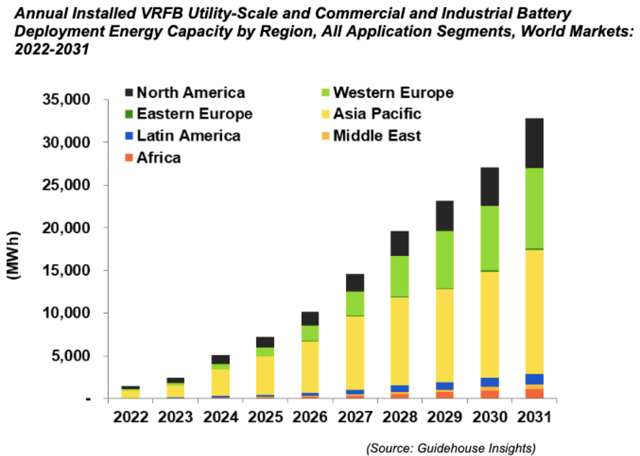

On June 8 Energy Storage News reported:

Rising flow battery demand ‘will drive global vanadium production to double by 2031’. The vanadium redox flow battery (VRFB) industry is poised for significant growth in the coming years, equal to nearly 33GWh a

year of deployments by 2030, according to new forecasting.

Energy Storage News

Energy Storage News courtesy Guidehouse Insights

On June 21 Energy Storage News reported:

Australian projects trial benefits of distributed neighbourhood and flow battery energy storage. The government of Victoria, Australia, has opened a round of funding for ‘neighbourhood-scale’ battery storage, while in Western Australia a vanadium redox flow battery (VRFB) will be deployed at a mining site… a project part-funded with an Australian Government Modern Manufacturing Initiative Grant will see a 300kWh VRFB installed at a mining site.

Note: See also June 20 news for Australian Vanadium, who via its subsidiary VSUN Energy is the VRFB supplier.

Vanadium miner news

Vanadium producers

Glencore [LSX:GLEN] [HK:805] (OTCPK:GLCNF)

Glencore is a large vanadium producer, but vanadium production represents only a small portion of their revenue.

No vanadium related news.

AMG Advanced Metallurgical Group N.V. [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

AMG Vanadium is a leading provider of products and services for the metals, manufacturing, refinery and petrochemical industries. AMG Vanadium produces ferrovanadium and related ferroalloys from spent refinery catalysts using a proprietary pyrometallurgical process.

No news for the month.

You can view the latest investor presentation here.

Bushveld Minerals Limited [LN- AIM:BMN] (OTC:BSHVF)

Bushveld is a diversified AIM-listed resources company with a portfolio of vanadium, tin and coal assets in Southern Africa and Madagascar.

On June 10, Bushveld Minerals announced:

Vametco signs five-year wage agreement with AMCU…Bushveld Minerals has agreed with the AMCU leadership a five-year wage deal on behalf of Bushveld Vametco employees…

On June 22, Bushveld Minerals announced:

Delivering sustainable growth – Key findings of Vametco and Vanchem studies to achieve 8,000 mtV p.a… a summary of the key findings of the feasibility and pre-feasibility studies (the “Studies”) by METC South Africa Pty (Ltd) and MSA Group [PTY] Ltd to assess the optimal path forward to grow production at Vametco and Vanchem to 8,000 mtVp.a. The Studies were undertaken to determine the next phase of the Company’s growth plans beyond the sustainable production run rate of between 5,000-5,400 mtVp.a., which is expected to be achieved by the end of 2022… The studies highlight a significant opportunity to increase production by c.50% to 8,000mt V p.a. through the Company’s existing operations. Requires growth capital expenditure of US$151 million (ZAR2.3 billion)…

On June 23, Bushveld Minerals announced: “Bushveld Energy secures funding for Vametco hybrid mini-grid.”

You can view the latest investor presentation here.

Largo Inc. [TSX:LGO] [GR:LR81] (LGORF)(NASDAQ:LGO)

Largo Inc. is a pure-play vanadium pentoxide producer from their Maracás Menchen mine in Brazil as well as a producer of VRFBs.

On May 30, Largo Inc. announced:

Largo announces acceptance of its notice to initiate a normal course issuer bid… Largo may purchase up to 3,641,098 Common Shares under the NCIB, representing approximately 10% of the public float of 36,410,986 Common Shares, as at May 20, 2022. Purchases of Common Shares may be effected through the facilities of the TSX, NASDAQ, and alternative trading systems during the period starting on June 1, 2022 and ending no later than May 31, 2023. Other than purchases made under block purchase exemptions, daily purchases on the TSX under the NCIB will be limited to 24,510 Common Shares, being approximately 25% of the average daily trading volume of 98,042 Common Shares on the TSX for the six calendar months prior to the TSX’s acceptance of notice of the NCIB.

You can view the latest investor presentation here.

Energy Fuels Inc. [TSX:EFR] (UUUU)

Energy Fuels state they are “the No. 1 uranium producer in the U.S. with a market-leading portfolio”, as well as being a small vanadium producer.

No news for the month.

Ferro-Alloy Resources [LON:FAR]

FAR is developing the giant Balasausqandiq vanadium deposit in Kyzylordinskaya Oblast of southern Kazakhstan. FAR state: “The ore at this site has a significantly higher grade than all other primary vanadium extraction sites, which allows for much lower processing costs.”

No news for the month.

Western Uranium & Vanadium Corp. (OTCQX:WSTRF)

Western Uranium & Vanadium Corp. own the Sunday Mine Complex which is an advanced stage mine property consisting of five interconnected underground mines in Colorado, USA.

On May 31, Western Uranium & Vanadium Corp. announced:

Western Uranium & Vanadium completes final delivery on 2015 supply agreement… The Company is in the best financial position in its history having generated approximately $12.8 million in positive cash flows during the first five months of 2022. Western’s robust balance sheet increasingly positions the Company to scale–up uranium/vanadium ore production on short notice….

Investors can read the latest company presentation here.

Vanadium developers

Neometals [ASX:NMT] (OTCPK:RDRUY) (OTCPK:RRSSF)

Neometals 100% own the Barrambie Titanium Vanadium Iron Project in Western Australia. Barrambie’s Eastern Band is one of the highest grade hard rock titanium deposits globally.

No significant news for the month.

You can view the latest investor presentation here.

Australian Vanadium [ASX:AVL] [GR:JT71] (OTC:ATVVF)

Australian Vanadium is an emerging vanadium producer focused on their Australian Vanadium Project in Western Australia. VSUN Energy was launched by AVL in 2016 to target the energy storage market for vanadium redox flow batteries [VRFBs].

On June 20, Australian Vanadium announced: “Vanadium battery standalone power system update. VSUN Energy’s vanadium redox flow battery (VRFB) project for IGO Limited (ASX: IGO) progresses, as unit begins international shipment to Western Australia.” Highlights include:

- “First VRFB-based standalone power system (SPS) project for a mining operation in WA.

- VRFB being shipped from manufacturer E22 in Spain.

- SPS to be trialled by IGO Limited (ASX: IGO) to target 100% renewable energy to power a water bore pump.

- Mining sector offers a wide range of opportunities for fossil fuel reduction using 100% renewable energy coupled with long duration energy storage (12+ hours) using VRFB SPS configuration by VSUN Energy.

- Project partly funded by $3.69M Australian Government Modern Manufacturing Initiative Grant.

- System design, testing and implementation are being completed by VSUN Energy, 100% owned subsidiary of Australian Vanadium Limited.”

On June 22, Australian Vanadium announced:

SPP Purchase Plan results. Australian Vanadium Limited is pleased to announce the results of the Company’s Share Purchase Plan [SPP] which closed on Thursday, 16 June 2022. The SPP complemented the Company’s recently completed placement to existing and new institutional, professional and sophisticated investors, raising $20 million (Placement) (ASX announcement 20 May 2022). The SPP received total subscriptions of $0.571 million, providing the Company with total funds of $20.571 million when combined with the Placement.

Catalysts include:

- 2022/23 – Possible further off-take and/or JV partner announcements.

You can view the latest investor presentation here, or read a Trend Investing CEO interview here.

Technology Metals Australia [ASX:TMT]

The Company’s primary exploration focus is on the 100% owned Gabanintha Vanadium Project located 40km south east of Meekatharra in the mid-west region of Western Australia.

No vanadium related news for the month.

You can view the latest investor presentation here.

TNG Ltd. [ASX:TNG] [GR:HJI] (OTCPK:TNGZF)

TNG is an Australian resources company focused on the evaluation and development of its Mount Peake Vanadium-Titanium-Iron project. The Mount Peake Project is located 235km north-northwest of Alice Springs in the Northern Territory of Australia. TNG Ltd. is well advanced with a massive $4.7b NPV8%, but relies on titanium and iron with a lower grade vanadium by-product.

No significant news for the month.

You can view the latest investor presentations here.

Vanadium Resources Limited [ASX:VR8]

Vanadium Resources is a junior exploration company established with the purpose of exploring and developing gold, zinc, lead, copper and other mineral opportunities. Vanadium Resources owns 74% of a globally significant vanadium project, the Steelpoortdrift [SPD] Project, in Gauteng Province, South Africa.

On June 22, Vanadium Resources Limited announced: “Pilot plant test work results confirm superior grade and recoveries.” Highlights include:

- “Pilot Plant test work indicates elevated overall recoveries of 84.4% indicating a 4% increase to metrics used for the Pre-Feasibility Study (PFS).

- Magnetic separation concentrates indicate reduction of reagent consumption compared to metrics used for the PFS, due to lower than expected Silica content.

- Magnetic separation test work indicates V2O5 recoveries in excess of 96% achievable at concentrate grades above 2.10% V2O5.

- Trial Mining, Bulk sampling and pilot plant test work completed.”

You can view the latest investor presentation here.

King River Resources [ASX:KRR] (formerly King River Copper)

King River holds 785 square kilometres of mineral leases covering a unique geological feature in the Eastern Kimberley of Western Australia, called the Speewah Dome. The company state on their website: “The focus of King River Copper Limited is the exploration for Gold, Silver and Copper.” However their deposits also contain vanadium.

No vanadium related new for the month.

You can view the latest investor presentation here.

VanadiumCorp Resource Inc. [TSXV:VRB][GR:NWN] (OTCPK:VRBFF)

VanadiumCorp Resource Inc. 100% owns the Lac Dore Vanadium-Iron-Titanium project in Quebec Canada. The Company also has royalties on the Raglan Nickel-PGM mine. The Company is looking to take a vertically integrated approach and is also developing leading process technologies ‘VanadiumCorp-Electrochem Processing Technology’ and “Electrochem globally patented Electrowinning” technology.

No news for the month.

You can view the latest investor presentation here.

Richmond Vanadium Technology Pty Ltd (“RVT”) ASX IPO planned for Sept./ Oct 2022 – Spin-off from Horizon Mining [ASX:HRZ]

RVT now owns 100% of the Richmond Vanadium Project. It has a global Mineral Resource of 1.8Bt @ 0.36% Vanadium Pentoxide (V2O5) at a cut-off grade suggests that it is one of the largest and highest-grade undeveloped vanadium resources in the world.

On June 15 Yahoo Finance reported:

Horizon Minerals Limited (ASX:HRZ) is pleased to advise that the restructure and demerger of Horizon’s 25% interest in the Richmond Vanadium Project (“RVP” or “Project”) into Richmond Vanadium Technology Pty Ltd (“RVT”) is now complete. The 1.8Bt Project is located in central north Queensland and has a completed Pre-Feasibility Study which demonstrated a technically viable and financially attractive development project. Work towards a Bankable Feasibility Study is currently being progressed.

Phenom Resources Corp. [TSXV:PHNM] (OTCQX:PHNMF) (formerly First Vanadium Corp.)

The Carlin Gold-Vanadium Property hosts one of North America’s largest richest primary vanadium deposits, located in Nevada. Its West Jerome project targets a large scale high grade copper and zinc deposit in Arizona. Carlin has a Historic Inferred Resource 28Mt at 0.525% V2O5 (2010 SRK).

On June 14, Phenom Resources Corp. announced:

Phenom Resources provides drilling update at Carlin. Paul Cowley, President & CEO of the Company states, “Frustrating as the delay was for us all, we are excited to be back drilling with an arsenal of refined targets developed on the Carlin and Smoke properties. And the delay did spawn a positive side as we utilized the time effectively to focus on and advance four important initiatives. The last 2 months were busy, 1) preparing multiple grant applications for U.S. Federal funding opportunities on the vanadium resource, 2) exploring partnership opportunities with a vanadium battery manufacturer, 3) advancing studies that would potentially reduce capital and operating costs on the vanadium project, and 4) finalizing drill targets and permits for expanded drilling plans on both the Carlin and Smoke projects. As each of these initiatives advance, the Company will report on their developments.”

On June 27 Phenom Resources reported:

Phenom Resources acquires 100% of Carlin Gold-Vanadium Project… The Carlin Gold-Vanadium Project hosts the Carlin Vanadium deposit. Underlying that is the Carlin-type gold system in which the Company is conducting vector drilling for high grade.

Investors can read the latest company presentation here.

Graphite miners with potential vanadium projects

- Syrah Resources [ASX:SYR] (OTCPK:SYAAF) (OTC:SRHYY)

- NextSource Materials [TSX:NEXT]

- DNI Metals [TSXV:DNI] [GR:DG7N](OTCPK:DMNKF)

Other listed vanadium juniors

- BlackRock Metals (Private)

- Gladiator Resources [ASX:GLA]

- Golden Deeps [ASX:GED]

- Intermin Resources [ASX:IRC]

- Maxtech Ventures [CSE:MVT]

- New Energy Minerals [ASX: NXE] (formerly Mustang Resources)

- Pursuit Minerals [ASX:PUR]

- QEM Limited [ASX:QEM]

- Sabre Resources [ASX:SBR]

- Strategic Resources [TSXV:SR] (OTC:SCCFF)

- Trigon Metals Inc. [TSXV:TM] (OTC:PNTZF)

- Voyager Metals Inc. [TSXV:VONE][GR:9VR1] (OTC:VDMRF) (formerly Vanadium One Iron Corp.)

- Venus Metals [ASX:VMC]

- Victory Metals [TSXV:VMX]

VRFB Companies

- Protean Energy [ASX:POW] [GR:SHE1]

- Enerox GmbH (90% Bushveld/10% Cellcube Energy Storage Systems)

- Invinity Energy Systems (LSE:IES) (OTCPK:IVVGF)

EV metal miners royalties companies

- Electric Royalties [TSXV:ELEC]

Conclusion

Europe vanadium pentoxide spot prices were slightly lower last month. China and Europe Ferrovanadium prices were generally flat.

Highlights for the month include:

- Vanadium stocks guide: Here’s everything you need to know. BloombergNEF says energy storage applications around the world will multiply exponentially from a modest 9GW/17GWh in 2018 to 1,095Gw/2,850GWh by 2040, marking a 122-fold boom over the next two decades.

- Rising flow battery demand ‘will drive global vanadium production to double by 2031’.

- A project part-funded with an Australian Government Modern Manufacturing Initiative Grant will see a 300kWh VRFB installed at a mining site.

- Bushveld Minerals releases results of Vametco and Vanchem studies to increase production by c.50% to 8,000mt V p.a. through the Company’s existing operations.

- Largo Inc. announces they may purchase up to 3,641,098 Common Shares

under the NCIB, representing approximately 10% of the public float. - Western Uranium & Vanadium completes final delivery on 2015 supply agreement.

- Australian Vanadium’s VSUN Energy’s VRFB project for IGO Limited progresses, as unit begins international shipment to Western Australia.

- Vanadium Resources Limited Pilot Plant test work results confirm superior grade and recoveries.

- Horizon Minerals Limited (ASX:HRZ) restructure and demerger of Horizon’s 25% interest in the Richmond Vanadium Project into Richmond Vanadium Technology Pty Ltd (“RVT”) is now complete.

- Phenom Resources acquires 100% of Carlin Gold-Vanadium Project.

As usual all comments are welcome.

[ad_2]

Source link